Introduction

Mastering Financial Strategy: Unlocking Business Growth and Profitability

Finance in business“Mastering Financial Strategy: Unlocking Business Growth and Profitability”A sound financial plan can frequently make the difference between success and failure in the fast-paced, cutthroat world of business. Entrepreneurs and company executives need to be aware of how important money is to securing profitability, promoting growth, and negotiating intricate market conditions. Regardless of your company’s size—startup, established, or multinational—developing a solid understanding of financial strategy can boost operational effectiveness, open up new growth prospects, and improve overall business sustainability.

The main components of financial strategy, its significance for company expansion, and how businesses can efficiently manage their financial resources to optimize profitability are all covered in this article. We’ll also go over the methods and resources managers and business owners may utilize to make wise financial choices and set up their organizations for long-term success.

The Foundation of Financial Strategy

The choices and actions a company makes to manage its financial resources in accordance with its overarching goals are referred to as financial strategy. Capital, assets, liabilities, revenues, and expenses are some examples of these resources. Optimizing the use of these resources to promote the expansion and long-term viability of the company is the aim of financial strategy. Managing daily finances is simply one aspect of a sound financial plan; other aspects include risk reduction, capital efficiency, and future growth planning.

A thorough awareness of the company’s current financial situation as well as the external economic environment is fundamental to financial strategy. Company executives need to be able to evaluate financial statements, identify any difficulties, and project future cash flow. In order to successfully navigate the intricacies of contemporary business environments, this degree of financial foresight is essential.

The Role of Financial Strategy in Business Growth

There are numerous ways for a business to grow, such as entering new markets or launching new goods or services. But attaining development necessitates prudent financial planning and skillful resource allocation. The following areas demonstrate how a sound financial plan supports the expansion of a business:

cash Allocation: The capacity to raise and distribute cash is a major factor in the expansion of a corporation. Whether through loans, equity investments, or reinvested profits, businesses frequently require outside money to support expansion efforts. A company that has a solid financial plan can assess the best ways to raise money and use it effectively. Prioritizing investments in high-return projects, maximizing working capital, and making sure the appropriate resources are distributed to support growth initiatives are all part of capital allocation.

Risk management: Businesses must manage financial uncertainty as growth invariably entails risk. A strong financial plan aids companies in recognizing, evaluating, and reducing these risks. Good risk management makes sure that unforeseen financial difficulties don’t impede expansion initiatives. A corporation might be shielded from unanticipated disruptions, for instance, by effectively managing cash flow or obtaining the right insurance coverage.

Revenue Growth: Increasing sales or refining pricing strategies are two ways that businesses can boost revenue. Businesses that have a solid financial plan are better able to balance pricing, cost structures, and profit margins as well as spot chances for revenue development. Moreover, it helps organizations to evaluate performance over time, assess the profitability of diverse revenue streams, and adapt their approach to maximize growth potential. Also Read https://ah1mods.online/wp-admin/post.php?post=176&action=edit

Cost Control and Efficiency: Effective cost management is a key component of financial strategy. Reinvesting resources in growth efforts can be made possible by cost-cutting and efficiency-boosting methods. Businesses can continue to be profitable even as they expand by figuring out where costs can be cut or procedures can be made more efficient. Budgeting, cost-benefit analysis, and variance analysis are examples of financial planning techniques that help firms maintain operational efficiency and reduce waste.

Profitability: The Key to Sustained Success

Any firm must prioritize expansion, but maintaining long-term success requires profitability. Companies that expand too rapidly without guaranteeing profitability risk running into financial difficulties very soon. For a corporation to succeed, a balanced strategy that prioritizes both growth and profitability is required.

Profit Margin Optimization: Achieving a healthy profit margin is one of any company’s main financial objectives. Increasing revenue while keeping expenses under control is one way to achieve this. By identifying the most effective pricing strategy, managing both variable and fixed expenses, and taking advantage of economies of scale, financial strategy plays a crucial part in maximizing profit margins.

Financial Forecasting and Planning: Based on past data and current market conditions, successful organizations frequently use financial forecasting to project future revenues, expenses, and cash flow. Business owners can anticipate difficulties, budget for upcoming costs, and guarantee there is enough cash on hand to keep things running smoothly with the help of accurate financial forecasting. Businesses can continue to generate a profit despite industry upheavals or economic downturns thanks to this forethought.

Cash Flow Management: Poor cash flow management can cause problems for even successful companies. Maintaining profitability requires having enough cash on hand to cover operating expenses, settle debts, and fund new initiatives. Monitoring accounts receivable, controlling inventories, extending payment periods, and lowering bad debts are all part of cash flow management.

Effective debt management is essential for long-term success for companies that depend on debt financing. A sound financial plan makes sure that debt is utilized to finance expansion without putting an undue strain on the business through high interest costs. Maintaining a good debt-to-equity ratio, obtaining advantageous financing terms, and making sure that debt repayments do not negatively impact cash flow are all part of debt management.

Tax Efficiency: Another crucial component of financial strategy is effective tax planning. Companies must minimize their tax liability through credits, deductions, and other tactics while adhering to tax legislation. By lowering the total tax burden and freeing up funds for expansion or reinvestment, a well-designed tax plan can have a big impact on a business’s profitability.

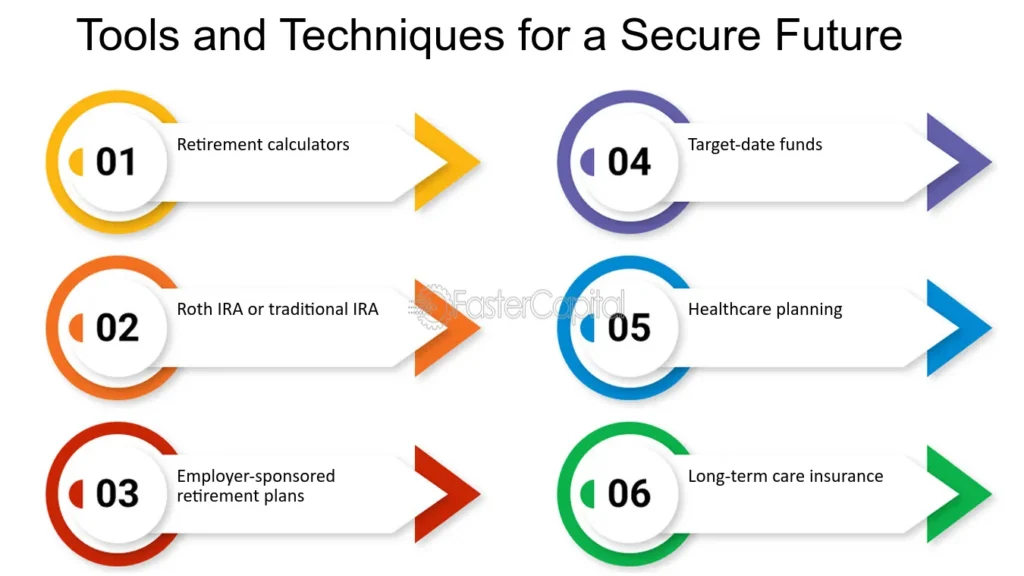

Tools and Techniques for Mastering Financial Strategy

Business executives who want to become experts in financial strategy need to have the appropriate tools and methods to make data-driven choices. They may manage resources, evaluate performance, and make appropriate strategy adjustments with the use of these technologies.

Financial Statements and Ratio Analysis: The cornerstone of any financial strategy is the financial statement, which includes the cash flow, balance sheet, and income statement. They offer information about the performance and financial health of a business. Business executives can assess how well a company is managing its resources and reaching its financial objectives by using ratio analysis, which includes profitability ratios (such as gross margin, operating margin), liquidity ratios (such as current ratio, quick ratio), and leverage ratios (such as debt-to-equity ratio).

Forecasting and Budgeting: Businesses can prepare for future costs and make sure that resources are distributed in accordance with strategic priorities by implementing a thorough budgeting process. Forecasting is the process of making predictions about future financial results using past data and current market patterns. Forecasting and budgeting work together to help firms foresee cash flow issues and modify their financial plans appropriately.

Cost-Benefit Analysis (CBA): Businesses frequently use CBA to assess the financial impact of initiatives or investments before deciding on them. This method assesses whether an investment will result in a profit by weighing the initiative’s possible advantages against its costs. Initiatives that have the greatest impact on long-term success and profitability are prioritized with the aid of CBA.

Key Performance Indicators (KPIs) are certain financial measures that companies monitor in order to evaluate their performance and advancement toward strategic goals. Working capital, gross profit margin, return on equity (ROE), and return on investment (ROI) are examples of common financial KPIs. Businesses can pinpoint areas for improvement and implement corrective measures to stay on course by keeping an eye on these data.

Scenario Analysis and Stress Testing: Scenario analysis is the process of looking at several possible future events and how they can affect the financial health of the company. In order to determine how resilient a company is to adversity, stress testing goes one step further by mimicking extreme occurrences or crises (such as supply chain disruptions or economic recessions). These methods assist companies in planning for unforeseen events and creating plans to reduce financial risk.

Building a Financially Savvy Organization

A culture of financial literacy across the entire firm is necessary to master financial strategy, not simply the knowledge of senior leaders. All staff members ought to be aware of how their actions affect the company’s bottom line. Company executives should spend money on financial training for employees so that everyone is aware of the significance of profitability, cash flow management, and cost control.

Furthermore, for all departments to be in agreement and work together, the financial strategy must be communicated clearly. Employees can make choices that support the company’s overall financial objectives when a clear and well-communicated financial plan is in place.

Conclusion: Unlocking Business Potential

Understanding financial strategy is essential to realizing the business’s full potential, not merely to balance the books or reduce expenses. By empowering companies to make wise decisions, distribute resources efficiently, and control risks, a strong financial plan stimulates growth. Businesses can successfully negotiate the intricacies of the business world, adjust to shifting market conditions, and achieve long-term success by concentrating on both growth and profitability.

Understanding financial strategy is more crucial than ever in the fast-paced, cutthroat industry of today. Businesses may secure their place in the market for years to come by positioning themselves for long-term growth and profitability with the correct strategy.

Incorporating flexibility into the finance strategy is also crucial for genuinely unlocking business potential. Market conditions can shift quickly, and business environments are always changing. In order to handle new possibilities or problems, firms must modify their financial plans. Continuous observation of external economic indicators as well as internal financial performance is necessary for this flexibility. Businesses can take advantage of emerging trends, maximize their investments, and maintain their competitiveness by remaining flexible and modifying their financial plan as needed.